India’s telecom market has been a battleground for major players like Reliance Jio, Bharti Airtel, and Vodafone Idea.

While Vodafone Idea (Vi) has seen some growth in Average Revenue Per User (ARPU), the company is struggling with high subscriber churn rates and insufficient network investments, as noted by analysts at Motilal Oswal Financial Services (MOFSL).

Current Market Position of Vodafone Idea’s Customer Base

Vodafone Idea was formed in 2018 from the merger of two major telecom players, Vodafone India, and Idea Cellular, to create a more competitive in front of rivals. However, the company has been dealing with mounting debt and subscriber losses since the merger.

As competition intensified, Vodafone Idea struggled to keep up with capital investments necessary to upgrade its 4G infrastructure and prepare an implementation for 5G.

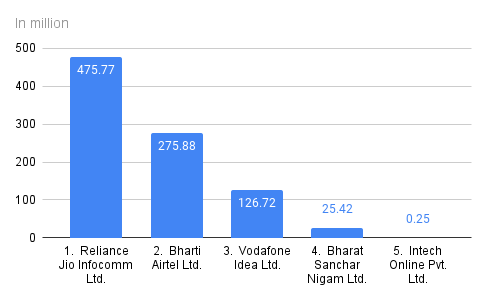

According to recent trai data, Vodafone Idea’s phone customer base stood at 126.72 million in July 2024, down from 127 million in June. Reliance Jio leads the market with 475.768 million mobile subscribers, while Bharti Airtel follows with 275.88 million.

Vodafone Idea’s failure to keep pace with network upgrades has been a key factor in losing subscribers, with competitors like Jio and Airtel benefiting from more robust infrastructure and a better customer experience.

Additionally, India’s telecom landscape saw a marginal drop in wireless subscribers overall, with the total number falling to 1.169 billion in July 2024. While Reliance Jio and Bharti Airtel continue to dominate, state-owned BSNL gained ground, increasing its customer base to 88.512 million from 85.581 million the previous month, as it did not raise mobile rates like its competitors.

For more insights on the impact of the Supreme Court’s AGR ruling on Vodafone Idea share, check out our AGR commentary, Click here.

Competitive Landscape for Vodafone Idea

In the highly competitive Indian telecom market, Reliance Jio and Bharti Airtel have pulled ahead through aggressive strategies, leaving Vodafone Idea struggling to keep up.

Reliance Jio revolutionized the market with its affordable data plans and widespread 4G coverage, gaining a massive subscriber base. Airtel, on the other hand, leveraged its superior customer service and network quality, alongside investments in 5G and other technologies.

Vodafone Idea’s biggest challenge is its limited ability to invest in network expansion, leading to a lower-quality customer experience than its rivals. Despite this, Vodafone Idea has positioned itself as a provider focused on better data monetization and higher-end user plans, driving improvements in ARPU.

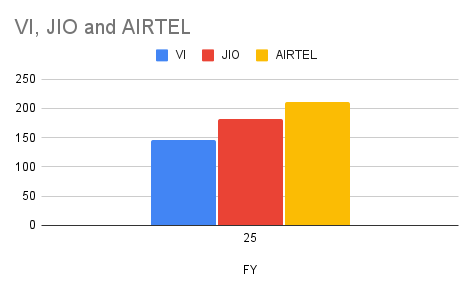

Average Revenue Per User (ARPU) of Vodafone Idea, Airtel and Jio

Average Revenue Per User (ARPU) is a key indicator of financial health in the telecom industry. Vodafone Idea reported an ARPU of Rs 146 in Q1 FY25, up from Rs 139 a year ago. The adoption of higher-value recharge vouchers and subscriber upgrades has driven this 4.5% growth in ARPU.

However, Vodafone Idea still lags behind its competitors—Reliance Jio’s ARPU stood at Rs 181, and Bharti Airtel reported an ARPU of Rs 210 during the same period.

The factors influencing ARPU include changes in entry-level plans, network quality, and the ability to attract high-paying customers. While Vodafone Idea has made strides in boosting ARPU, its ability to compete effectively will require significant improvements in network quality and customer retention strategies.

Financial Health of Vodafone Idea

Vodafone Idea’s financial health is not good and worsened after AGR, with the company reporting heavy losses over the past few years.

In the fiscal year ending March 2024, Vodafone Idea posted a net loss of Rs 30,409.8 crore, slightly higher than its Rs 29,297.6 crore loss in FY23. While the company managed to reduce its capital expenditures (CapEx) from Rs 6,008.9 crore in 2022 to Rs 1,613.9 crore in 2024, this also meant fewer investments in improving network infrastructure—one of the key reasons for its subscriber losses.

Vodafone Idea’s cash flow from operating activities has improved slightly over the years, reaching Rs 20,826.1 crore in FY24. However, the company’s financing activities, including debt repayments, remain a significant burden.

In FY24, the company had net cash outflows of Rs 18,980.3 crore from financing activities, driven by debt repayments of Rs 16,112.6 crore. Read this to get an idea, How Much Debt Does Vodafone Idea Have? AGR and Spectrum